You may have heard of the term “estate plan”. Perhaps you know it has something to do with your Last Will and Testament. But what exactly is an estate plan and how do you set one up?

In short, an estate plan is a set of documents that allow you to control your health and financial affairs when you are alive, but unable to handle them yourself, and also take care of your financial affairs after you have passed away. There are five classic documents that form a complete estate plan, but two additional documents that we feel, in 2016, that you should add to round out your plan.

They key word here is “plan”. These documents all allow you to describe what will happen if you are unable to take care of things yourself. You name individuals to take on your responsibilities and provide them with clear instructions on what to do. Which means that you can only prepare these documents when you have full mental capacity. You cannot wait until you no longer have capacity. If this ever happens to you, through illness or accident, it is then too late to prepare any of these documents.

Copyright: marigranula / 123RF Stock Photo

What makes up a traditional estate plan?

We regard a complete estate plan as

Last Will and Testament,

Lasting Power of Attorney for property and financial affairs,

Lasting Power of Attorney for Health and Welfare,

Advance Directives

Funeral Wishes

LifeLocker (or list of your assets)

Vault (to handle your intangible or emotional assets, or “ethical Will”)

Be careful when you read about Estate planning for other countries. Some countries include things like irrevocable Living Trusts, and Guardian Designations that don’t really apply to the UK.

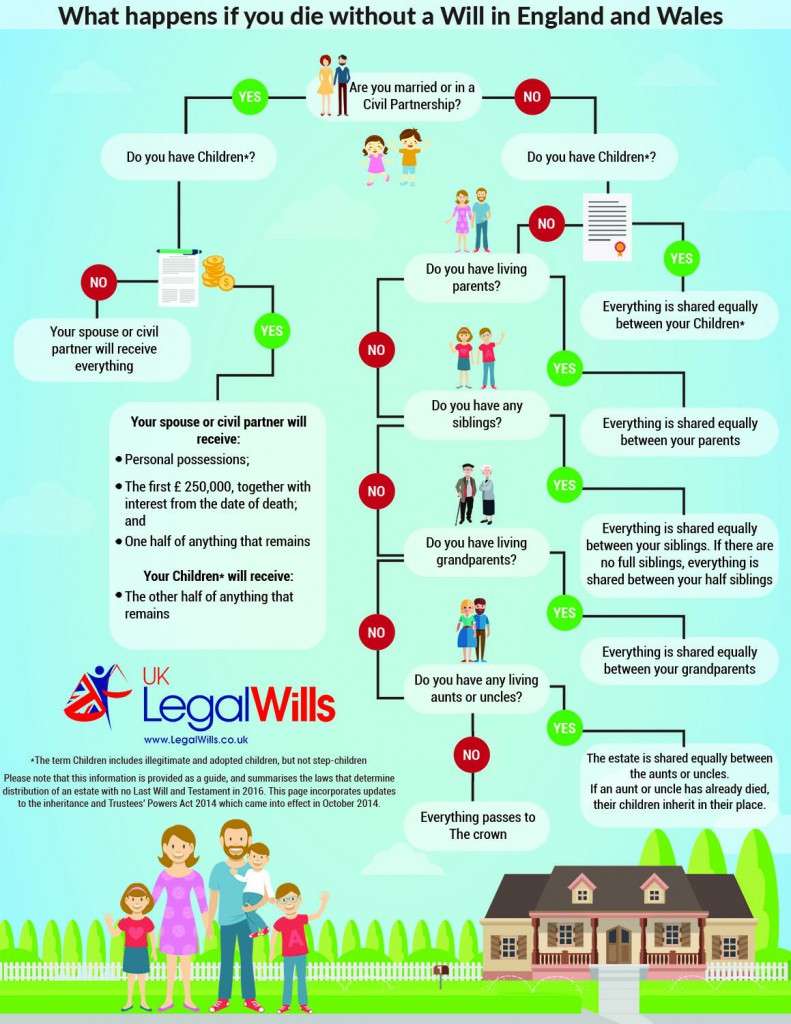

Last Will and Testament

Everybody needs a Last Will and Testament. At some point you will die, and when this happens, things are a lot easier for your family if you write a Will.

Your Last Will and Testament serves two key purposes. It allows you to make appointments; you can name the person who will take care of everything on your behalf (your Executor). You can also name guardians for your children. If you do not make these appointments in your Will, the courts will make these appointments on your behalf. Your estate will need an estate administrator (or “Executor”). You can either make that appointment, or allow a judge to make that appointment for you. Your Executor is responsible for gathering and securing your assets, using those assets to pay your debts and taxes, and then distributing the assets according to the instructions in the Will.

If you have young children, and both parents are involved in a common accident, the children will need guardians. Again, you can make that appointment in your Will, or you can leave the responsibility to a judge. Unfortunately, the judge knows very little about your family and loved ones, and will make the best appointment with the information that they have to hand. Maybe it will be the same person that you would have appointment, maybe it isn’t.

In addition, your Will allows you to describe the distribution of your estate. This is the essence of an “estate plan”. Who would you like to benefit from your estate?

Bequests in a Last Will and Testament

There are three different types of bequest;

- A specific monetary gift or “pecuniary legacy”. This would be something like £1,000 to your favourite niece to travel the World. Or £5,000 to the RSPCA.

- An item. So you can leave your house, your car, your Rolex watch, or signed Bobby Moore shirt to a named individual.

- A percentage of your estate. Everything that remains after your specific gifts falls into your “residual estate”. You don’t know which assets you will own when your Will comes into effect. It could be next week, it could be 30 years from now. So every Will has a residual clause that states “give everything that remains after debts, taxes and specific gifts to my three children in equal shares”. Or you could leave “25 percent of your residual estate” to a person or charity.

Your Last Will and Testament typically runs about 5 or 6 pages and includes more detail about what your Executor can and cannot do, set up trusts for young beneficiaries and adds more legal structure to your wishes. But in essence your Will makes appointments and describes the distribution of your estate.

You can prepare your Will conveniently and affordably using the Will writing service at LegalWills.co.uk. You simply step through the service, and then download and print your document. Once you sign this in the presence of two witnesses, it becomes a legal Last Will and Testament.

Lasting Power of Attorney for property and financial affairs

If something were to happen to you and you lost the capacity to handle your own financial affairs, things can get very tricky for your family and loves ones. You may have bills to pay, you may be required to co-sign on documents, you may need to move money from one account to another.

Fortunately, you are able to name a person to take care of things on your behalf should you ever lose capacity. You must create the document while you are competent, and it will come into effect if you become no longer competent. It is a critical part of your estate plan.

Many offices and online services provide Power of Attorney services. But they charge several hundreds of pounds to prepare a Power of Attorney on your behalf. But since 2007 these independent services don’t really offer much value. Lasting Powers of Attorney are administered by the Office of the Public Guardian (OPG), and they actually have a really well designed online tool for preparing the document. This service is free.

Registering the Lasting Power of Attorney

In order to be a legal document however, you must file and register it with the OPG. This costs £110 per document. So if a couple want to create a financial and healthcare Lasting Power of Attorney, it will cost £440.

At LegalWills.co.uk we are struggling to see the benefits offered by any service provider offering Lasting Power of Attorney services. The online tool at the Office of the Public Guardian is free and better than any other online service that we have seen.

Please don’t pay to create a Lasting Power of Attorney (but you do have to pay to register the document in order to make it legal).

Lasting Power of Attorney for Health and Welfare

The same rules apply to the other type of Lasting Power of Attorney – the Health and Welfare LPA. You can create it using the tool at the OPG website, but you must also register it with the OPG for £110.

The difference is that the Health and Welfare LPA allows you to nominate a person to make medical decisions on your behalf. This person has no authority to make financial decisions for you, only medical decisions.

Advance Directives as part of your Estate Plan

Your Lasting Power of Attorney for Health and Welfare does not include an extensive expression of your wishes for end of life care. The only qualifier in the LPA is the option to choose ” I want to give my attorneys authority to give or refuse consent to life-sustaining treatment on my behalf”.

In addition, you can express your Advance Directives. At LegalWills.co.uk we include this under our “Living Will” service.

Our service allows you to specific the types of life sustaining treatment you wish to receive under different conditions. As well as your End of Life Care. Our Living Will service also allows you to describe your wishes for organ donation.

You should store this document with the other items in your estate plan.

Don’t forget your Funeral wishes

There is a very common misconception that you should include your Funeral Wishes as part of your Last Will and Testament. There are a couple of reasons why this is a poor choice.

Firstly, your Will is a legal document approved by the courts and accepted by your financial institutions. Your funeral wishes are nothing more than an expression of your preferences. They are not legally binding and do not have to go through the same rigorous signing procedure as the Will. Your funeral wishes are not a legal document, but they should be a part of your estate plan.

In addition, your Will takes a while before the probate courts approve it. By the time the Will has gone through the official process of being accepted as your legal Last Will and Testament, your funeral will probably have been long taken care of.

You should include your funeral wishes as part of your estate plan, but they should be described in a separate document to be stored with your Will. At LegalWills.co.uk, we include a separate, free service called MyFuneral where you can describe your preferences and print a final document that can form part of your estate plan.

The modern estate plan

We have now covered the traditional documents associated with a complete estate plan. But in 2016 we believer there are two other critical documents and services that you can use to ease the burden on your family and loved ones.

MyLifeLocker

Imagine if you were to die today and you have written your Will. Hopefully you have told your Executor where they will find your estate planning documents, and they can now work to administer your estate.

Your Will is going to have a residual estate clause that says “the remainder of my estate to be divided equally between by two children”.

Your Executor now has to gather up your estate. Have you considered how this may be done?

Traditionally, an Executor would go through your filing cabinet, look at your bank statements, perhaps your insurance policy statements, and phone the number at the top of the page. There was a good chance that your estate would be distributed across three or four financial institutions.

It doesn’t work like this anymore. You probably receive your statements by email, or perhaps even through the banking app on your phone. You probably have a number of credit cards, and bank accounts. You may also have PayPal accounts, online banking, online investments. Perhaps you have revenues coming in from an online account.

21st century estates

Today estates are far more distributed and fragmented. What makes things worse is that today, there is seldom a paper trail to these accounts.

You could write everything down on a piece of paper and hope that your Executor finds this list of accounts, but you may not keep it up-to-date, and you may be concerned about the document falling into the wrong hands at the wrong time.

This is why we invented LifeLocker as a 21st century addition to your estate plan. It has become the ultimate Executor handbook.

With MyLifeLocker you document your assets and important information. You can then name a “keyholder” who can gain access to the document at the appropriate time (and not before). Armed with your LifeLocker the Executor’s job becomes much easier, and you no longer run the risk of your assets not being found.

In fact all of our services make use of our keyholder mechanism to protect the documents. You name a person you trust to gain access to your document, they can then log in with their unique keyholder ID and access the information that they need when they need it.

MyVault

At LegalWills.co.uk we’ve offered the Will service for over a decade now and first came online in 2001. But over the last decade we’ve continued to develop services to help our clients. Our latest innovation is our Digital Vault service at MyVault.

Do you have any important documents that you need to be kept in your family and handed down to the next generation? These can be photographs, journals, documents, or even spreadsheets with User ID’s and passwords.

You can now upload any file to our Vault service. You nominate a keyholder who can unlock the vault and gain access to these documents. This is the 21st century shoebox but with security and gatekeeper features.

There are certainly services online that offer this functionality, but ours is free for half a gigabyte of data. That’s enough for your entire photo collection.

The complete Estate plan

At LegalWills.co.uk we provide all of the services your need to organise your estate plan. We do not have Lasting Power of Attorney services because the Office of the Public Guardian actually has a great service to help with this (we do feel that the registration fee is a little too high, but for now that is the only option). However, we do offer services to help you express your funeral wishes, write your Will, describe your Advance Directives, document your key assets through LifeLocker and even store important files that can get into the right hands at the appropriate time.

You don’t have to complete your estate plan in one sitting. It’s something that you can work on over a period of a few weeks, and updated throughout your life. So why not get started now and ensure that your loved ones are not left with a complete mess on their hands if anything were to happen to you.

Your estate plan is not really about you, it’s a caring act for your family and the people you are leaving behind.

- Can I include my pet in my will? | Providing for your pets by leaving money in a pet trust in your estate plan - April 25, 2023

- My parents didn’t have a Will. This is what I did. - June 3, 2022

- The duties of an Executor of a Will - May 10, 2022