You can’t help but feel honoured when you’re named as the Executor of the estate of a family member or friend. It’s a sign that you’re trusted and respected. However, that sentiment might change when you realise what the task fully entails – a pile of work! In this article we will give a high level explanation of the duties of an Executor.

It can take at least a year (more likely 18 to 24 months if the estate is particularly complex) to administer the distribution of the estate including the time waited for probate, tax filing and general processes. This is during a period of emotional turmoil – both in grieving for the deceased and in navigating family tensions over how the estate is divided. On top of that, Executors are financially liable for their mistakes and are increasingly being held to account both by beneficiaries and by the courts.

Therefore, if you have recently been asked to be an Executor or if you have already agreed, you might want to brush up on your legal duties and Executor basics before formally accepting the role.

The Basics

When somebody dies, many people assume that their ‘next of kin’ will sort out their affairs, but this isn’t often the case. When someone has made a Will and appointed Executors in their Will, the Executors will be responsible for carrying out the deceased’s wishes. At LegalWills.co.uk we require all Wills to have a named Executor.

After an individual’s death, his or her assets will be gathered, business affairs settled, debts paid, the funeral arranged, and assets distributed as the deceased set out in their Will. These activities will be the responsibilities of the Executor. The work of the Executor involves corresponding with other parties, keeping meticulous records, filling out forms and being answerable to creditors, beneficiaries and the intentions of the deceased, as recorded in the Will.

As an Executor it is vital that you read and fully understand the Will so that you will know who the beneficiaries are, what they are to receive and when, and who, if any, your co-Executors are.

The Will often includes important directions to the Executor, such as which assets should be used to pay taxes and expenses. It will also list the Executor’s powers in some detail, outlining what they do and don’t have the authority to do.

Some Executors retain a solicitor who specialises in family law to assist them in performing their duties properly. Be mindful that if you accept the appointment to serve as an Executor, you will be held responsible for understanding and implementing the terms of the Will. Executors can be held personally liable for the decisions they make in the course of estate administration. Although Executors are acting in good faith, errors or disagreements can result in the Executor and the estate being sued by beneficiaries.

In the UK, probate fraud seems to be on the increase and is estimated to cost at least £150 million a year. Therefore, over the past ten years the courts have become harder on Executors than they used to be. Recent case law demonstrates that the courts are imposing costs on Executors now in situations where they never would before if they made a mistake.

Debts, Taxes and Expenses

It is the Executor’s duty to determine when they should pay bills unpaid at death, and expenses incurred in the administration of the estate, and then pay them or notify creditors of a temporary delay.

In the UK, there’s normally no Inheritance Tax to pay if either:

- the value of your estate is below the £325,000 threshold

- you leave everything to your spouse or civil partner, a charity or a community amateur sports club

If you give away your home to your children (including adopted, foster or stepchildren) or grandchildren, your threshold will increase to £425,000.

If your estate is worth more than the threshold, you will pay the standard Inheritance Tax rate of 40%. For Example if your estate is worth £500,000 and your tax-free threshold is £325,000. The Inheritance Tax charged will be 40% of £175,000 (£500,000 minus £325,000).

Most expenses that an Executor incurs in the administration of the estate or trust are properly payable from the deceased’s assets. These include funeral expenses, appraisal fees, attorney’s and accountant’s fees, and insurance premiums. Careful records should be kept, and receipts should always be obtained. If any expenses are payable to you or someone related to you, consult with a solicitor about any special precautions that should be taken.

A Word on Probate

One of the most common questions we receive is “does the Will have to be probated?”. To answer this, you must understand the purpose of probate.

Probate is the official legal process for validating the Will and accepting it as the official Last Will and Testament. It is the opportunity for multiple Wills to be presented, Wills to be contested, and Wills to be invalidated. At the end of the probate process, the named Executor is given a court issued document called a “Grant of Probate” that officially appoints them as the estate administrator. It gives the Executor the authority to gather all of the assets, and then distribute them to the beneficiaries.

All banks have a threshold at which they will ask for the Will to be probated. But not only banks. If you have premium bonds that the Executor needs to cash out, National Savings and Investment (NS&I) will require the Will to be probated. No financial institution can risk giving the money to the wrong person and they have no way of validating the Will themselves.

In general if an estate is worth more than about £5,000, probate will be required. But each bank has their own threshold.

Aviva – £50,000

AXA – £10,000

Barclays – £50,000

Britannia – £30,000

Cheltenham & Gloucester – £25,000

Co-op Bank – £30,000

Halifax – £50,000

HSBC – Decided on a case-by-case basis.

Lloyds TSB – £50,000

Nationwide – £50,000

Natwest – £25,000

NS&I – £5,000 to £15,000 depending on the will and the number of Executors

Post Office – £10,000

Santander – £50,000

All of these numbers are approximate guides, and it really depends on your relationship with the bank, and the bank’s perceived risk of giving the money to the wrong Executor.

If probate is needed, then you would start by going to the government website and completing form PA1P. (If there is no Will, the process is slightly different and you would need to complete form PA1A).

Carrying out the bequests

Wills often provide for specific legacies of cash (“I give my niece £20,000 if she survives me”) or property (“I give my grandfather clock to my granddaughter”) before the balance of the property, or residue, is distributed. The residue may be distributed outright or in further trusts, such as a trust for a surviving spouse or a trust for minor children. Be sure that all debts, taxes, and expenses are paid or provided for before distributing any property to beneficiaries because you may be held personally liable if insufficient assets do not remain to meet estate expenses.

Most of the time, beneficiaries will pressure Executors to make an interim distribution because it can take months before the estate is finally wrapped up and all taxes paid off. However, beneficiaries should understand that they cannot force an Executor to make an interim distribution because it means the Executor is assuming risk for the payment of estate taxes. If you are unsure on how to proceed, it is always worth discussing your options with a solicitor who can explain the full interim distribution process to you and your legal responsibilities.

Where distributions are made to ongoing trusts or according to a formula described in the Will, it is best to consult a solicitor to be sure the funding is completed properly. Tax consequences of a distribution can sometimes be surprising, so careful planning is important.

Investing estate funds

Unless an Executor has financial experience, he or she should seek professional advice regarding the investment of assets in the estate. A skilled investment advisor can help the Executor decide how to invest, what assets to sell to produce cash for expenses, taxes or outright gifts of cash, and how to minimise income and capital gains taxes. Simply maintaining the investments that the decedent owned will not be a defence if an heir claims you did not invest wisely or violated the law governing estate investments. In all events, it is important to have a written investment policy statement stating what investment goals are being pursued.

Closing the estate

Estates may be closed when the Executor has paid all debts, expenses, taxes, and has distributed all assets on hand. Trusts terminate when an event described in the document, such as the death of a beneficiary, or when the beneficiary attains a specific age, occurs. The Executor is given a reasonable period of time thereafter to make the actual distributions. As stated above, administering an estate can be a very time consuming process and delays for various reasons should be expected. If it’s all finished within a year, you should pat yourself on the back because it often takes longer, and in some cases it can take years.

Executors without prior experience typically underestimate the amount of time and work involved. Additionally, you may not realise that you need to keep clear records. These help the Executors keep track of what they are doing as beneficiaries, creditors or the court might also ask to see them.

It is good practice to require all beneficiaries to sign a document, prepared by a solicitor, in which they approve of your actions as Executor and acknowledge receipt of assets due to them. This document protects the Executor from later claims by a beneficiary. Finally, a final tax return must be filed on behalf of the estate and a reserve kept back for any due, but unpaid, taxes or estate expenses (if using the interim distribution process).

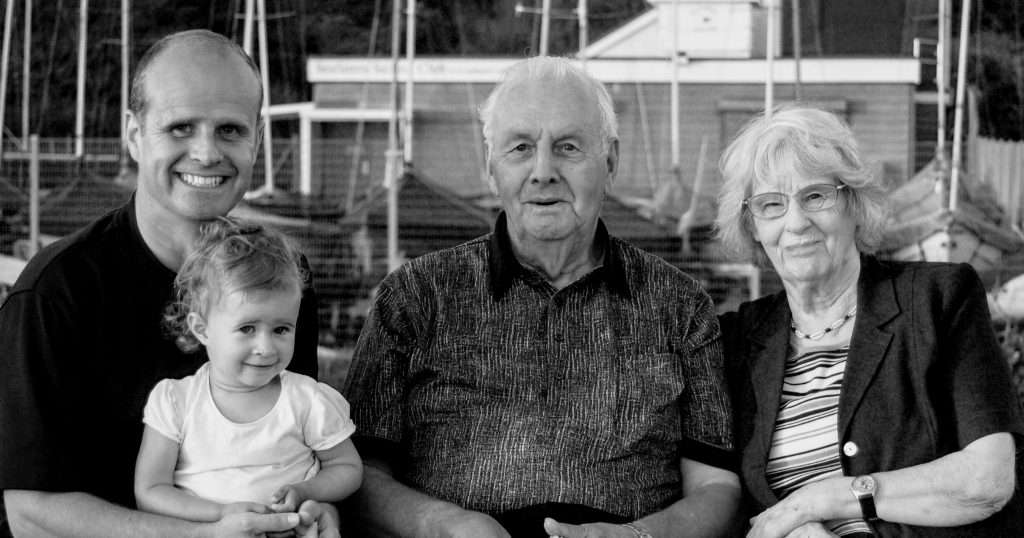

As we can see, agreeing to be an Executor is a big obligation and not one to be taken lightly. If you believe yourself unable to undertake the role, the best thing would be to refuse as you could be held legally accountable for any mistakes. And if you are currently writing your Will and wondering who to pick as an Executor, consider how large the task is that you’re handing off and who you can fully trust with your possessions and finances. It is sometimes helpful to have more than one Executor so that the task can be shared and as a contingency plan, but these people must also be willing and able to work together.

Don’t feel pressured into accepting the position if you really don’t think that you are able to do it. Today, there are many alternatives, as solicitors and even third party companies are able to take on the task.

- Can I include my pet in my will? | Providing for your pets by leaving money in a pet trust in your estate plan - April 25, 2023

- My parents didn’t have a Will. This is what I did. - June 3, 2022

- The duties of an Executor of a Will - May 10, 2022