“A note on Privacy: the protection and security of the documents created on our web site are of critical importance. In particular, we cannot access any information contained in a specific Will, nor can we read a person’s Will. However, we are able to access aggregated data from an encrypted database folder that summarizes the number of times particular choices have been made within our service. We cannot connect this information to individual accounts. It is this data that has been mined to provide the information on planned giving in this article”

At LegalWills.co.uk, we help thousands of people in the United Kingdom create their Last Will and Testament through our online Will service. A Will contains a lot of important information, such as who will receive your property when you pass on and who will be the guardians of your children, and it can also serve as a great way to give back to the charities you support upon your death. Leaving money or assets to a charity is called “planned giving,” – a service that LegalWills.co.uk offers for all its Wills. According the Charities Aid Foundation, “in terms of giving money to charity (either directly or through sponsorship of an individual), 70 per cent [of people in the UK] report doing so in the 12 months prior to interview [for the study], and 44 percent do so in a typical month.”

This information evidently shows that charitable giving is an important part of the lives of many people, so we were interested in the level of “planned giving” going on in the United Kingdom. According to Russell James, the number of people aged 55+ with a charitable estate beneficiary hovers between 5% an 6%.

So, even though there are professional member organisations dedicated to promoting planned giving and thousands of people working for this sector, it seems that around 95% of people are not including charitable bequests in their Wills.

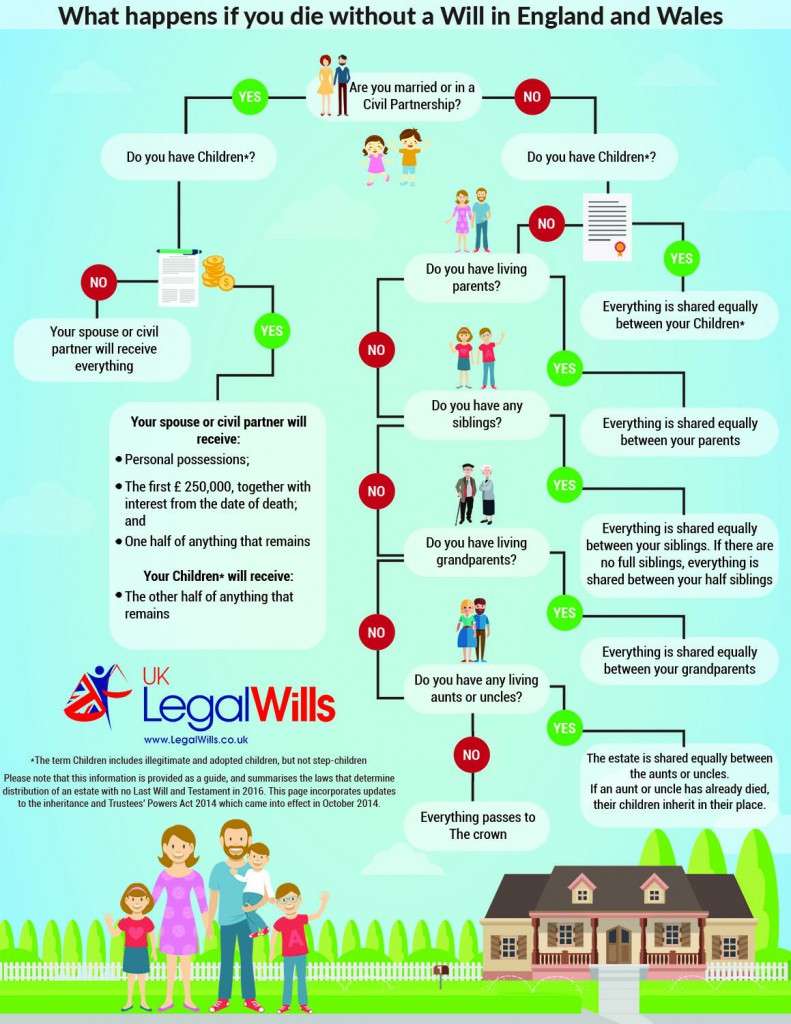

This statistic can be a little misleading, since we know that around half of those people don’t even have a Will, and the charitable estate plans are likely to only be created by people with a Will in place. No Will means no planned giving.

Increasing interest in Planned Giving

In 2014, we heard of a study from the UK that suggested appropriate prompting when writing a Will could increase the level of planned giving threefold, and double the average size of a charitable bequest.

After hearing about this study, we realized that at Legalwills.co.uk that we had missed an opportunity to promote charitable giving within our service. We immediately implemented a charitable bequest prompt page that all users of the service would see when preparing their Will.

By including this page, we are also able to run some statistics on planned giving within the United Kingdom.

Customer and business confidentiality prohibits us from providing specific details on charitable bequests, but we are able to generate some generic reports that offer some valuable information about the state of planned giving in the United Kingdom. These statistics were pulled from the last year and are drawn from over 5,000 Wills created through our service.

Our data source

These are real Wills, created by real people. These are not survey results, or information obtained from questionnaires. Wills can be updated throughout one’s lifetime, so there is a chance that bequests will be added or removed from these Wills, and thus these statistics provide a snapshot.

It is also worth mentioning that we offer an affordable estate planning service, so it is likely that individuals with a very high net worth would not be using our service. Having said that, there were bequests of £80,000 in some Wills created using our service. We know that although we do not necessarily cater to the top 1 percenters, the remaining 99 percent are open to using our service.

A study of probate records in Australia showed that when comparing self-written Wills, Wills prepared through a kit, online software and Wills prepared by a legal professional

“Analysis indicated that there is no statistical relationship between the form in which a will is prepared and the likelihood of including a charitable bequest.”

In other words, the level of planned giving was not statistically different whether the Will was prepared using an online Will service like ours, or using another method, such as a lawyer.

Why Give a Charitable Bequest?

Many people would like to give to charities, but find themselves without enough funds to donate in any substantial amount. Even if a person is doing well financially, there is still a worry that they or a family member will fall ill or suddenly need money, so often people hesitate to donate in any substantial capacity. By donating in the form of a charitable bequest, which is only donated after death, it alleviates this worry, since upon the death of the donor, the funds would no longer be needed by him or her. This means it is easier to donate in larger amounts than one would be able to during a lifetime.

Charitable bequests are also easy and simple. They can easily be written into a Will with a few sentences, but can also be removed with a subsequent Will or codicil. This is attractive to some donors, since they are able to augment or retract their donation if their circumstances change.

Though a charitable bequest in a Will is only donated upon the death of the donor, it can still be comforting to know that one’s money is being used for the greater good after one passes away.

Some charities understand this impact very well, and so have create marketing angles like the “one percent” campaign from Rainbow Trust.

If charities received 1% of the value of every estate in the UK, it would generate £71m towards good causes this year alone.

By taking a more measured approach to planned giving, you avoid battles and resentment from the family. This conflict was captured in a recent Guardian article “Battle of the bequests: animal charities v disinherited relatives”

Some Key Demographics

In terms of age, users of our service are split nearly 50:50, with 55% of users being men and 46% being women. Other key demographics include marital status and age, which are listed below:

Aggregate Charitable Gifts

In 2015, 3.7% of users included a charitable bequest in their Will. Most charitable bequests are made to health organisations, such as cancer research charities, and international aid organisations like Oxfam.

When a customer drafts their Will with LegalWills, they are prompted with the option to leave a charitable bequest. However, the prompt only asks if they would like to make a request as oppose to suggesting specific charities to donate to. LegalWills is more than happy to include a charity’s name in a prompt that asks for a charitable bequest, but demand for this service has been low. As a result, customers have to enter in the charity’s information if they wish to leave a bequest, as opposed to just clicking on a prompt. Since people are more likely to do something if it is easy, this could be a factor in reducing the number of charitable bequests that are left by LegalWills.co.uk users.

Nature of our Bequests

Of all the bequests, 66% were specific sums of money, 26% were percentages of the person’s residual estate, and 5% were specific assets such as a car or a painting.

Classifications of Planned Giving

We were unable to find an industry standard classification for the charity sector, so as a result we created our own logical categories to sort the recipients of our service’s charitable bequests:

Animal – this includes vets, the RSPCA, animal rescue organisations, World Wildlife Fund and other wildlife organisations.

Church/Spiritual – included all religious denominations, from religious leaders to specific churches.

Health – this category includes charities focused on individual conditions, such as cancer, diabetes, AIDS, etc.

Hospital foundations – a self explanatory group that includes any hospital, but excludes general health charities listed in the above. We contemplated collapsing this sector into the health category, but decided against it.

Community – this included any charities working to improve the areas where we live (e.g. food banks, homeless shelters, children’s charities), and we also included Rotary clubs, mountain rescue centres and the RNLI in this category. This sector also included faith-based charities with mandates to improve society, but who are distinct from the church/spiritual category, which includes bequests to benefit the actual organisation.

Environment – Conservation charities are included in this category if they were not solely focused on animals, such as Greenpeace.Wetland Trust, The National Trust.

International Aid – this is a general group of bequests that are likely to be diverted overseas e.g. Oxfam, Save the Children, Amnesty International etc.

Arts – includes any museums, art galleries, choirs or other musical organisations.

Education – all universities, schools and colleges.

Special Interest – We included this category to capture donations to small professional bodies, memorial funds, clubs, societies and hobby groups.

Politics – since political parties didn’t really fit into any of the categories, we made a separate category for bequests to political parties and other political organisations.

We counted each bequest only once, even though some organisations blurred the lines between categories (for example, a church-based charity focusing on worldwide heath issues), so each bequest can only appear in one category.

As demonstrated by the graph above, health-focused organisations receive the highest number of charitable bequests, with international aid, animal and community organisations following close behind. Arts charities and hospital foundations receive the smallest number of bequests. This is interesting seeing as health organisations receive the highest number, while hospital foundations receive the lowest, even though they are both focused on improving the health of humans.

Value of Bequests

LegalWills offers three types of planned giving options: specific dollar amounts, percentages of residual estates, and specific assets. Specific assets can be anything from a car to a book collection to a piece of property.

The study of probate records from Australia reported that:

“Charitable bequests made as a specified $ value gift were on average significantly lower in value than those made as a residual of the estate:

- $7,000 median value of specified charitable bequests

- $200,000 median value of residual bequests.”

For this report, we split up the specific sums and calculated the average size of a monetary legacy given to each charitable sector.

The total average charitable bequest given as a specific sum of money is about £5,953, with the following breakdown:

On the graph above, environmental groups and hospital foundations received the highest average amount for a specific cash bequest. However, it is worth noting that there were only two data points for each of those categories, with one of them being a very large sum of money, so it is not really fair to compare those two categories to all the others, since the other categories had far more data points. The only exception to this is the arts category, which had only one data point. If environmental organisations, hospital foundations and arts charities are removed, the amount for the other categories can be seen more clearly:

Once the adjustment is made to include only categories that have a substantial number of data points, church/spiritual groups come out on top. This is interesting, since that category fell in the middle of the graph when examining how many bequests each category received. Health, the category that received the highest number of bequests, falls near the middle of the graph.

Percentages of estates go a long way

Percentage of estates can also be a relatively large amount of cash. An estimated figure for the average size of a residual estate, aggregating data from different statistical sources and life expectancy information we estimate that the average estate size hovers around £274,000 for our users. A report published in 2013 put the number at £265,000 so we would appear to be quite close in our estimate.

Even just 10% of this data is £27,400, which is a very significant sum. The average percentage of residual estate left for charitable bequests across all categories is about 18%, which is about £49,320.

When broken down by category, the environmental category leads the charge with an average charitable bequest of 100% of the residual estate. This is due to there being only one data point in the environmental category, which happened to be 100%. Additionally, special interest groups and arts organisations also had only one data point each. Hospital foundations and educational organisations are notably absent from this graph, since they did not have any data points for the percentage of residual estate category.

Once the environmental, special interest and arts data points are removed, since they are unable to provide an accurate representation of the sector with just one data point, the graph looks much more even.

In this new graph, health, community and international air organisations are all close in number, while animal and church/spiritual charities lag slightly behind. This is interesting when compared to the graph depicting the number of specific sums of money that are given to each sector, since in that graph, church/spiritual groups received the most money.

Total Distribution Across Charitable Sectors

In order to get an idea of the total distribution of planned giving by charitable bequests per sector, we totaled up all the specific sum bequests and added a dollar value to the bequests that consisted of a specific asset, such as a car or a property. In order to calculate the value of each residual estate, we used the aforementioned £274,000 figure as the average size of a residual estate and multiplied each percentage donation by that figure. If this were an more academic piece of writing as opposed to a blog post, we would likely be more rigorous in the approach to research, but using these figures works to illustrate what categories obtain the majority of the money coming in from charitable bequests.

Health organisations are at the top of the list, receiving one quarter of all money donated through charitable bequests. International aid, community and animal-related charities follow closely behind, commanding around 20% of total donations each. Arts, education and special interest charities, as well as hospital foundations, receive only a small percentage of the total donation pool each.

When comparing the amount of money each sector gets with how many donations each sector gets, the numbers are relatively similar. Health organisations still take up about a quarter of the market, with community, international aid and animal-related organisations following closely behind. Arts, education and special interest charities, as well as hospital foundations, only command a small percentage of the number of bequests, just like in the previous graph.

Death is something that no one wants to think about. But preparing for your passing is critical to ensure those that you leave behind are not left inconvenienced and stressed in a time of grief. By writing a Will, you take care of your family even after you’re gone. Leaving a charitable bequest in your Will can be an excellent way to give back upon you passing, especially if you are not in a place financially to be able to donate at the present time.

If you have any comments about this article, or would like to learn more about data collected by our service regarding planned giving, please comment below.

If you are a charity and would like to work with us at LegalWills.co.uk, please contact us at [email protected]. We would be happy to partner with you to make our contribution to increasing the level of planned giving in the UK.

- Can I include my pet in my will? | Providing for your pets by leaving money in a pet trust in your estate plan - April 25, 2023

- My parents didn’t have a Will. This is what I did. - June 3, 2022

- The duties of an Executor of a Will - May 10, 2022