couples

Featured Articles

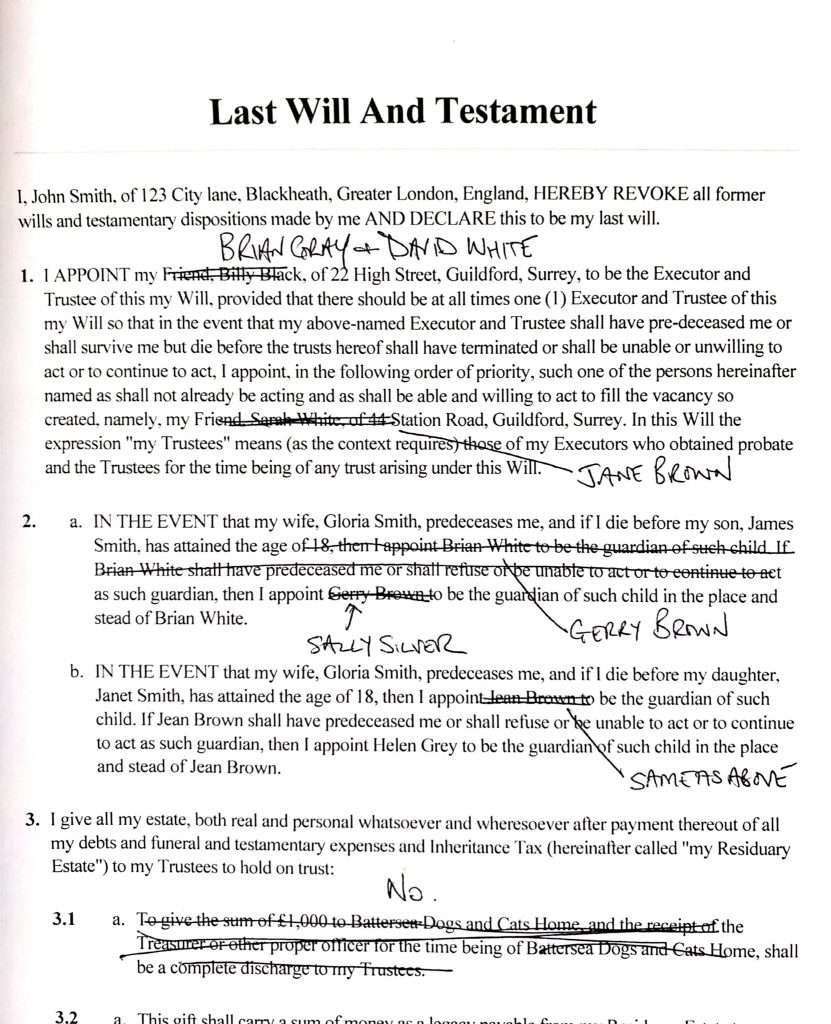

The duties of an Executor of a Will

You can’t help but feel honoured when you’re named as the Executor of the estate of a family member or friend. It’s a sign that you’re trusted and respected. However,...

Continue reading