There are a surprising number of misconceptions surrounding the workings of a Last Will and Testament. In this article we want to break down the most important points of a Will, so that you can truly understand how a Will works. Here we discuss ten key elements to a Will. Understand these, and you are on your way to understanding exactly how a Last Will and Testament works.

1. A Will must be written

There are a few different approaches to writing a Will, but even though we are well into the 21st century, there is no getting around the requirement that a Will must be in writing. The law does not allow for a Will to be an audio recording, a video recording, stored on an iPhone, stored on your computer, or verbally explained to a friend.

There are a few odd exceptions to this general statement. For example, a “Nuncupative Will” is a verbal or oral Will that is permitted, but only for an active service person on active duty. This exception to the law was to allow a soldier on the battlefield, mortally wounded, to explain how they would like their assets to be divided. It is a very specific exception, but it is written into UK law.

In Australia, a Will was written on an iPhone and accepted by the courts. But it did have to go to the Supreme court of Queensland, and was accepted under very specific conditions. It is not an approach to take for the rest of us.

Some jurisdictions around the world are also accepting electronically signed Wills. British Columbia in Canada has brought in new legislation to accept a Will written, signed and stored entirely electronically. Four US States also currently accept this. The UK has no plans to allow electronic signatures on Wills.

Having established that a Will needs to be written (or typed) on a piece of paper, there are three general approaches to writing your Will.

- You can work with a solicitor who can write your Will for you. You then sign the document in their presence, and the presence of one other witness, and this becomes a legal Last Will and Testament. You can also take the same approach with a professional Will writer (not a solicitor) to get a similar result. Professional Will writing is not a regulated profession in the UK, so anybody can set themselves up as a Will writer.

- You can write your Will in your own handwriting on a scrap of paper, or using a blank form Will kit that you purchase from WHSmiths or the Post Office. There used to be a Post Office Will kit, but this is no longer available.

- You can use online Will writing software like the service at LegalWills.co.uk. You are guided through a series of questions, at the end of which your Will is compiled based on your answers. You then download and print your Will, and sign this in the presence of two adult witnesses (who are not beneficiaries in the Will). At this point it becomes a legal Last Will and Testament.

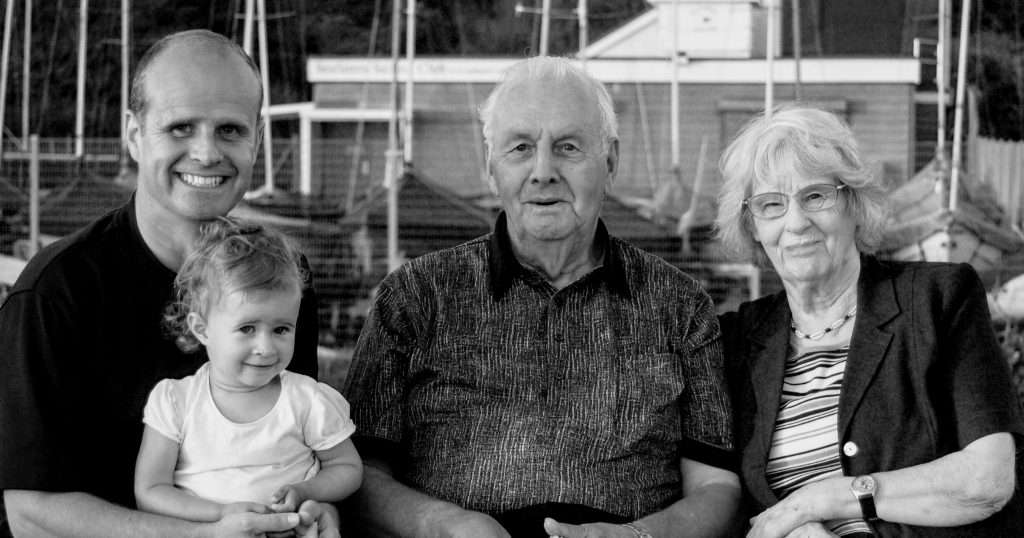

2. A Will should be written and updated throughout your lifetime

Most adults in the UK don’t have a Will in place. Many feel that they don’t need one yet, or that it can wait until they are older, or when they feel that they are closer to death.

The common misunderstanding is that you write a Will at the end of your life. But in fact, a Will is just a part of your complete financial plan. You should write a Will as soon as you become an adult, and then update it throughout your life as your circumstances change.

Traditionally, writing a Will was an expensive and time consuming process. If you worked with a solicitor, your Will would cost £500 or more to prepare. With this type of expense, you would want to ensure that the document never needed to be updated.

However, online Will writing services make the process of updating your Will much more convenient and affordable. Many online services allow you to maintain an account and update your document as many times as you wish. You therefore no longer need to hold off until your life has “settled down” or your circumstances are unlikely to change.

You should write your Will today, and review it on a regular basis.

3. A Will must be written while you are completely competent

Related to the previous point, it is sadly quite possible to wait until it is too late to prepare your Will. We frequently hear from customers saying “My father is in intensive care in the hospital, and he doesn’t have a Will, how can he write one?”. Or “My mother has dementia and doesn’t recognise anybody, but I know that she doesn’t have a Will. Can we write one for her?”.

Sadly in situations like this, it is not possible to write a Will for somebody else. Even if you have a Lasting Power of Attorney (LPA) in place, you cannot prepare somebody’s Will for them. A Will must be written when you are fully competent, you understand that you are writing your Will, and you understand the implications of preparing the document. You must understand the general contents – the key appointments and the distribution plan for your estate.

Not only must you be competent to write your Will, but also to make any updates to the document. Many disputes and challenges to Wills happen because they are updated in the final weeks and months before a person’s death. There is always a strong argument that a person is not of sound mind, and perhaps easily influenced when they are changing their Will in the last few days of their life. You cannot make changes to your Will if you are not completely competent to do so.

4. A Will does absolutely nothing all the time you are alive, it only comes into effect after you have died

The following is a question that comes up from time-to-time:

Caller: “My father has left me out of his Will, can I challenge it?”

LegalWills: “When did your father die?”

Caller: “Oh no, he’s not dead yet.”

A Last Will and Testament has absolutely no effect on anything while the testator (the person for whom the Will is written) is still alive. You cannot challenge the Will of somebody who is still living. In fact, the document can be cancelled, revoked or updated at any time throughout a person’s lifetime. Even when a Will is written, it is not an irrevocable contract. Anything written into a Will can be changed all the time the testator has the capacity to make that change.

Once the testator has died, and the Will has been accepted as the Last Will and Testament, then it can be challenged. But there are very specific reasons why a Will can be challenged, that we have covered in another post.

5. You can do some very interesting things in your Will

The main part of your Will describes the distribution of your assets. Your assets are your money, home, car, investments, family heirlooms, etcetera. In fact every single thing that you own is an asset, and all of your assets together make up your “estate”.

The simplest Wills usually leave the entire estate to a single “beneficiary” (the person receiving the “bequest”). You may leave your estate shared between a few different beneficiaries, for example, “divided equally between my children”.

Your Will also allows you to leave specific bequests to individuals or charities. This could be a sum of money to your favourite nephew, your grand piano to your niece, and your signed Bobby Charlton shirt to your grandson.

You can also leave possessions or a sum of money to a charity including animal wellness, your church, your school or a social cause.

When you don’t prepare a Will, you actually miss an opportunity to do something quite rewarding with your estate.

Think of Roger Brown who left £3,500 in his Will to seven close friends who were required to spend it on a boozy weekend in a European city of their choice.

6. Your Will isn’t just about describing who receives what

There are some other key elements to your Will beyond distributing your assets. One of the most important is the naming of your Executor. This is often a friend or family member who you are entrusting to follow the instructions in the Will. Your Executor needs to file the document with the probate courts, gather and then secure your assets. They must then pass them to your beneficiaries. It is quite a responsibility, but with no Will, nobody is put in charge of your affairs.

Your Will also allows you to name guardians for your children. If you are a single parent, or if you are involved in a common accident with the other parent, then somebody will have to raise your young children. Your Will is a place where you can make that appointment.

Your Last Will and Testament names not only guardians for children, but also guardians for your pets. You are able to set up a “pet trust” in your Will that names a caregiver, and also gives your caregiver an amount of money to be used in the care of each pet. The service at LegalWills.co.uk has a specific page for this that goes into some very useful detail.

7. The Will probably needs to be probated

You may be interested to know what happens after you have died. You have named an Executor in your Will who has to gather up your assets and pass them to your beneficiaries. Unfortunately, this is not as simple as your Executor going to your bank with the Will in hand.

Your bank has no way to check the validity of the Will. They will not know if a Will was written after this one, or whether there has been a challenge made to this Will. The banks and financial institutions rely on a process called “probate”.

Probate is the court process for validating a Will, making sure that the document is the official Last Will and Testament, and then granting the powers to the Executor to serve as your Estate Administrator. The Executor will be given a “Grant of Probate” that can then be presented to the banks and other financial institutions as proof that they have the power to gather the assets. Certainly organisations like NS&I require a Will to be probated before cashing out Premium Bonds.

Probate does not require a physical appearance in court, but it does require forms to be submitted and reviewed, and then more forms to be submitted and reviewed. It can be a long, drawn out process, and as a government department, it is one of the least efficient. Unfortunately, it is difficult to bypass the probate office.

The are exceptions of course. If the total assets are valued at less than £5,000, then probate is not necessary. In fact some banks will release accounts of up to £50,000 but it very much depends on the bank. If all assets are held jointly and simply passing to the joint asset holder, then probate is also not required.

8. The Executor named in your Will has to follow the instructions in the Will

Once probate has been granted and your Executor has received their grant of probate, they will gather all of your assets and secure them. This means for example that your home should be secured and all of the possessions in the home should be accounted for. Nothing should mysteriously disappear simply because somebody claims that it was promised to them.

The Executor must follow the instructions for distributing the estate, but they do have some discretion. For example, if your Will explains that everything should be divided equally between your three children, then your Executor is required to fairly make that division. The worst case scenario is that everything is sold and the proceeds are divided equally, but it would be nice if your Executor could say “John will receive the china tea service and Jane can receive the diamond engagement ring. Brian can therefore have all of the photography equipment.”.

Some things are more difficult to value, and so your Executor may be required to bring in professional appraisers. For example, valuing cryptocurrencies against artwork is not easy.

9. Living without a Will in place, and dying without a Will is never a good plan

Do you need a Will? The answer is always “yes”. There is never a situation where it is better to die without a Will. If you die without a Will, nobody is in charge of your affairs, and this invariably leads to family tension. Your assets will not be secured, and it will not be clear who will receive what.

There is a strict legal formula for the distribution of your assets if you do not have a Will, but this usually requires everything to be liquidated and the money passed to the beneficiaries. You will not have named guardians for your children, nor somebody to care for your pets. You will not have left any charitable bequests, and all of your cherished possessions will likely just be sold at auction, or taken to your local charity shop.

Dying without a Will is a missed opportunity, and places undue stress on the family and loved ones that you have left behind.

10. It is neither time consuming nor expensive to write a Will

Fortunately, it is not difficult to write a Will. More people are using online services like the one at LegalWills.co.uk to write their Will. At LegalWills.co.uk the cost for the Will service is just £49.95 and the whole process takes about 20 minutes.

You are guided through a series of questions in everyday language. At the end, your document is compiled using all of the correct legal clauses. You then simply download and print the document and sign this in the presence of any two adult witnesses to make it a legal Will.

With services like LegalWills.co.uk there is really no reason to be living without a Last Will and Testament in place.

- Can I include my pet in my will? | Providing for your pets by leaving money in a pet trust in your estate plan - April 25, 2023

- My parents didn’t have a Will. This is what I did. - June 3, 2022

- The duties of an Executor of a Will - May 10, 2022